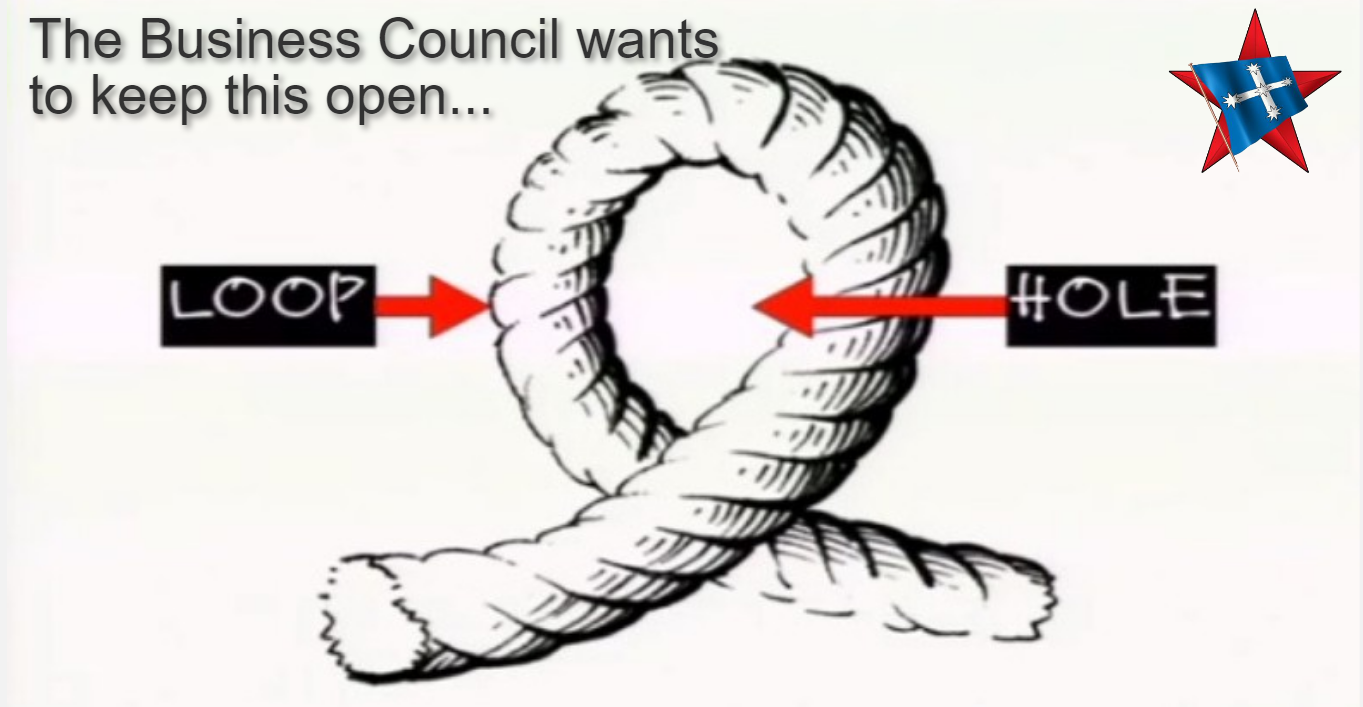

Bosses deny need for “Closing the Loopholes” Bill

Written by: (Contributed) on 14 October 2023

While the 'Closing Loopholes Bill' makes its way through parliament and into law the response from the Business Council of Australia (BCA) and their associates has been particularly interesting and quite predictable. Once implemented the new laws will potentially benefit millions of workers, especially those in low-paid and vulnerable employment by enhancing their workplace rights and living standards together with increasing their opportunity to raise loans with enhanced credit-ratings.

Elsewhere, however, a related matter linked to inflation has received scant publicity although it remains of huge significance to the Australian workforce; the Closing Loopholes legislation, however, is unlikely to be effective and there remains an urgent need for further legislation to prevent blatant racketeering by the business-classes.

The Closing Loopholes legislation is making its way through parliamentary processes at the present time. It will have far-reaching benefits for millions of workers once implemented; problems arising from casualisation, wage and super theft, same job same pay, failure by employers to update workplace agreements within the allocated time frame and various other matters will become legislation by the end of the year. Millions of Australian workers will return to their places of employment in the New Year with different contracts of employment and enhanced pay and terms and conditions of employment.

Australia has an estimated 2.7 million casual workers from a workforce of about eight million. (1) Many of those not officially included within the category, however, continue to remain on less than full-time 38 hour a week permanent provision, with a multitude of alternatives such as permanent part-time and fixed-term contracts, rendering them vulnerable with employers using master and servant workplace relations to control workers.

The response from the BCA and those associated with the employer's organisation has been useful to monitor, if only to identify their continued ability to deny the existence of problems in all industries across Australia. Their latest ploy has included an attempt to refer the proposed legislation to the Productivity Commission, 'in order to avoid an economic calamity'. (2) Those concerned, however, have not been specific about which areas of the legislation they regard as responsible for the pending calamity they allege they face.

Some industries, hospitality, retail, transport and agriculture, in particular, have problems with rampant underpayment, and flouting of basic terms and conditions of employment remains commonplace. The legislation contains provision for dealing with the matter.

A Senate inquiry last year concluded with grim findings that an estimated 13 per cent of the Australian workforce were subject to wage theft, amounting to about $1.3 billion per annum. (3) It also noted that the problem was the outcome of business practices, and, 'systemic wage theft is often a deliberate decision of businesses that participate in a race to the bottom to bring down wages and increase profit'. (4)

The BCA and their associates, nevertheless, have been quick to try and undermine the legislation, without being too specific with content.

Their arguments and suggestions, nevertheless, have been revealing; bleating that the legislation will cost businesses up to $9 billion in extra wages over the next decade, they did not even bother to explain how they had conducted their calculations. (5) It is remains significant to note how those responsible for the calculations can specify the total cost, while not having the ability to read awards and regulations which have been flouted by wage-thieves on their behalf to maximise profit over obligation.

Some of their cronies in mainstream media outlets, likewise, have used their 'expertise' to draw attention to the casualisation issue. One, having access to a large feature spread in the Business Australian, attempted to argue those who were casualised workers were so by choice; Australians, furthermore, benefited from what they referred to as the 'gig economy'. (6) A statement from Canberra, however, quickly clarified the urgent need for the legislation to be passed; it noted, 'everyday it is delayed is another day that gig workers have no minimum standards, agreed rates are undercut and wage theft is not considered criminal'. (7)

The inability of casualised workers to raise even small loans due to their low credit-ratings, was an issue not addressed. Casuals frequently have difficulty with even basic financial planning. The fact the business-classes casualise employment in order to undermine awards and other regulations was also an issue not addressed or even acknowledged.

Numerous examples of business practices merging with unethical and illegal activity can, nevertheless, be easily assessed from reliable sources in the public domain; they have been caused by the same cost-cutting mentality and flagrant disregard for established rules, laws and regulations designed to ensure accountability and compliance with ethical business practices. It remains a sad reflection of contemporary corporate Australia and high inflation rates they are largely responsible for creating. (8)

The other side of the present price / profit inflation caused by the business-classes is that Australian workers have lost between 20-25 per cent of their spending power over the past eighteen months; the problem of food inflation is also particularly noteworthy. Recent studies have concluded Australian supermarket food prices rose dramatically during the past twelve months. (9)

In the previous twelve months to April, for example, food inflation rose 9.6 per cent, to June, 8.8 per cent, to July, 7.6 per cent, and to August, 8.5/9.0 per cent. (10)

Other areas of concern include automotive fuel prices surging with petrol and diesel prices rising by 9.1 per cent in the twelve months to August, rents rising 7.8 per cent during the same period, as did electricity prices by 12.7 per cent and gas prices by 12.9 per cent. (11)

Meanwhile, corporate Australia continues to record mega-profits, while criticising the working class and demonising the trade union movement - so much for a fair go!

1. Business blasts 'flawed' IR bill, Australian, 27 September 2023.

2. IR laws risk economic 'calamity', Australian, 2 October 2023.

3. Senate inquiry calls for laws to stamp out 'systemic, sustained and shameful' wage theft, ABC News, 30 March 2022.

4. Ibid.

5. Business blasts, Australian, op.cit., 27 September 2023.

6. See: Why we need gig economy, Australian, 27 September 2023.

7. IR laws, Australian, op.cit., 2 October 2023.

8. See: ASIC in crackdown on reporting laggards, Australian, 29 September 2023; and, 'Aggressive growth' unstuck PwC., Australian, 28 September 2023; and, PwC Australia boss insists culture problem is local, Australian, 28 September 2023; and, Starting as one means to continue? Australian, 28 September 2023.

9. Food prices outpacing inflation, Australian, 26 September 2023.

10. Ibid.

11. Volatile inflation muddies the water for RBA., Australian, 28 September 2023.

Print Version - new window Email article

-----

Go back

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Articles

| Civil defence and the imperialist agenda |

| On the introduction of supermarket security checkpoints |

| WOMAD: Marley to perform, Palestinian musicians banned |

| International Women’s Day lifts struggle for liberation of women and socialism! |

| ICOR Call for International Women’s Day |

| We support the international campaign to free Ecevit Piroğlu |

| Workers’ power and closing the loopholes industrial laws |

| Sovereignty, a message to whitefellas |

| When whitefellas dance Ceremony, it’s time for consequences |

| RIghts Of Indigenous Peoples’ Struggles Continue As Governments Side With The Big End Of Town |

| Community school mural censored over First Nations artist's identity with Palestinians |

| Miko Peled speaks truth about the Zionist war against Palestine |

| #FreeDanDuggan - A Fight for Freedom and Australian Sovereignty |

| Mr Mundine, stop harming kids if you want them to go to school! |

| Opposition to Zionism is not anti-Semitism. |

| How Secure Are Australia's Defence Bases? |

| Corporate management and the Alliance for Responsible Citizenship |

| Imperialism and the Israeli state condemned Palestinians to poverty. |

| Microsoft buys into AUKUS and Australian surveillance industry |

| After the referendum, we cannot fight blindly |

-----